Context

COVID-19 has had a severe financial impact on people living in Canada.

An Angus Reid institute 1 survey conducted from March 20-23, 2020 found that:

- 34% of respondents said they worried about missing rent or mortgage payments this month.

- 44% of respondents said they or someone in their household has lost work.

- An additional 18% of respondents said they expect to lose work soon, and more than half of those currently working say their hours will be cut.

The MNP Consumer Debt Index 2, released March 30, 2020, found that half of Canadians are now on the brink of insolvency. Only $200 separates these people from defaulting on their debt obligations each month. A quarter of these people said they are already unable to meet those obligations.

COVID-19 continues to cause financial strain to many people both worldwide and in Canada. It has put increased pressure on people who were already experiencing poverty, as well as those who were previously financially stable.

In this context, accessing benefits can lead to additional stress due to program and eligibility rules. People must find and read through information about all benefits available in order to learn:

- Which benefits are relevant for them.

- The amount of assistance they could expect to receive from each benefit.

- Where and how to apply.

- When they could expect to receive each benefit.

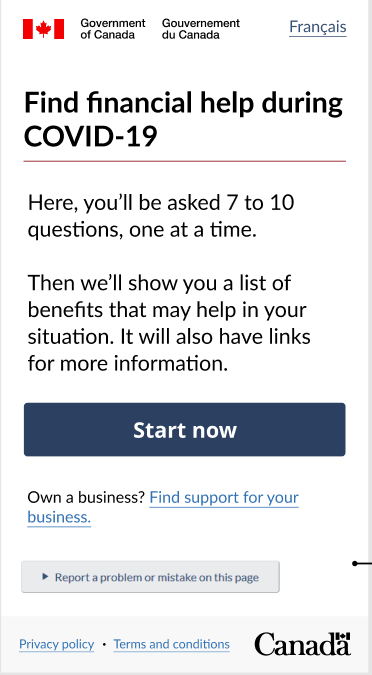

The benefit finder allows people to match benefits to their individual situation. It shows them how much assistance they can expect, how frequently they can expect it, and when they will receive it. This information helps people make immediate financial decisions and determine their next steps.

Footnotes

-

1 COVID-19: Those least equipped to endure economic downturn bearing the brunt of layoffs. - Angus Reid Institute ↩

-

2 The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians. ↩